There are two major economic and budgetary issues which Congress must address in the lame-duck session or soon afterward. First, how do we reverse the decline of the middle class and create the jobs that unemployed and underemployed workers desperately need? Second, how do we address the $1 trillion deficit and $16 trillion national debt in a way that is fair and not on the backs of the elderly, the children, the sick or the poor?

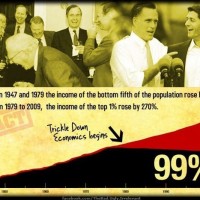

Both of these issues must be addressed in the context of understanding that in America today we have the most unequal distribution of income and wealth of any major country on earth and that the gap between the very rich and everyone else is growing wider. Today, the top 1 percent earns more income than the bottom 50 percent of Americans. In 2010, 93 percent of all new income went to just the top 1 percent. In terms of wealth, the top 1 percent owns 42 percent of the wealth in America while the bottom 60 percent owns just 2.3 percent.

In my view, we will not make progress in addressing either the jobs or deficit crisis unless we are prepared to take on the greed of Wall Street and big-money interests who want more and more for themselves at the expense of all Americans. Let’s be clear. Class warfare is being waged in this country. It is being waged by the Koch brothers, Sheldon Adeslon, Mitt Romney, Paul Ryan and all the others who want to decimate working families in order to make the wealthiest people even wealthier. In this class war that we didn’t start, let’s make sure it is the middle class and working families who win, not the millionaires and billionaires.

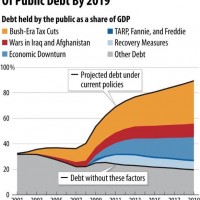

In terms of deficit reduction, let us remember that when Bill Clinton left office in January of 2001, this country enjoyed a healthy $236 billion SURPLUS and we were on track to eliminate the entire national debt by the year 2010.

What happened? How did we go from significant federal budget surpluses to massive deficits? Frankly, it is not that complicated.

President George W. Bush and the so-called “deficit hawks” chose to go to war in Afghanistan and Iraq, but “forgot” to pay for those wars — which will add more than $3 trillion to our national debt.

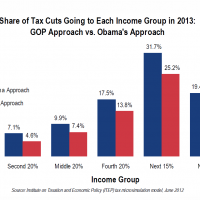

President Bush and the “deficit hawks” provided huge tax breaks to the wealthiest 2 percent of Americans — which will increase our national debt by about $1 trillion over a 10-year period.

President Bush and the “deficit hawks” established a Medicare prescription drug program written by the pharmaceutical and insurance industries, but they “forgot” to pay for it — which will add about $400 billion to our national debt over a 10-year period.

Further, as a result of the greed, recklessness, and illegal behavior on Wall Street, this country was driven into the worst recession since the Great Depression which resulted in a massive reduction in federal revenue.

And now, as we approach the election and a lame-duck session of Congress, these very same Republican “deficit hawks” want to fix the mess they created by cutting Social Security, Medicare, Medicaid and education, while lowering income tax rates for the wealthy and large corporations. Sadly, they have been joined by some Democrats.

The fiscal crisis is a serious problem, but it must be addressed in a way that will not further punish people who are already suffering economically. In addition, it is absolutely imperative that we address the needs of 23 million Americans who are unemployed or underemployed.

What should working families of this country demand of Congress in response to these crises? Let me be specific:

First, at a time when the effective tax rate for the rich is the lowest in decades, we must repeal the Bush tax breaks for the top 2 percent which will reduce the deficit by $1 trillion over the next 10 years.

Second, we must recognize that Wall Street caused the economic crisis, and that it has a responsibility to reduce the deficit. Establishing a 0.03 percent Wall Street speculation fee, similar to what we had from 1914-1966, would dampen the dangerous level of speculation and gambling on Wall Street, encourage the financial sector to invest in the productive economy and reduce the deficit by $350 billion over 10 years. Importantly, this fee, like similar levies in many other countries, would not apply to ordinary investors, retirees or parents saving to send their kids to college. Rather, it would apply to Wall Street investment houses, hedge funds and speculators who sell credit default swaps, derivatives and operate other risky financial schemes that nearly brought down the entire economy.

Third, we have got to prohibit offshore tax shelters. Each and every year, the United States loses an estimated $100 billion in tax revenues due to offshore tax abuses by the wealthy and large corporations. The situation has become so absurd that one five-story office building in the Cayman Islands is now the “home” to more than 18,000 corporations. According to a recent report by James Henry, a former chief economist at McKinsey, the wealthiest people in the world are hiding between $21 trillion to $32 trillion in offshore tax havens to avoid paying taxes. About a third of this amount, according to one estimate, is from wealthy Americans. The wealthy and large corporations should not be allowed to avoid paying taxes by setting up tax shelters in Panama, the Cayman Islands, Bermuda, the Bahamas or other tax haven countries. Cracking down on these tax evaders could reduce the deficit by about $1 trillion over the next decade.

Fourth, at a time when we have almost tripled military spending since 1997 and spend nearly as much on the military as the rest of the world combined, we must reduce unnecessary and wasteful spending at the Pentagon. According to a number of experts, the Pentagon today cannot account for hundreds of billions of dollars in its budget. Even Sen. Tom Coburn (R-Okla.), perhaps the most conservative senator in this country, believes that we could reduce defense spending by $1 trillion over a 10-year period while ensuring that the United States continues to have the strongest and most powerful military in the world.

Fifth, we have got to eliminate tax breaks for companies shipping American jobs overseas. Today, the United State government, despite our losing over 55,000 factories in the last 10 years, continues to reward companies that move U.S. manufacturing jobs overseas through loopholes in the tax code. Eliminating these loopholes would raise more than $582 billion in revenue over the next ten years and bring jobs back home to America.

What else? Ending corporate welfare for big oil, gas and coal companies; requiring Medicare to negotiate with the pharmaceutical companies for lower drug prices; taxing capital gains and dividends the same as work; establishing a progressive estate tax; and eliminating waste, fraud and abuse at every agency in the federal government would reduce spending by more than $350 billion and raise a significant amount of revenue without harming the middle class.

Taking these steps would reduce the deficit by more than $5 trillion.

Finally, and importantly, with these kinds of savings we could invest aggressively in rebuilding our crumbling infrastructure, transforming our energy system away from fossil fuels and restoring our manufacturing base. That investment could create millions of decent paying jobs, make our country more productive and help us lead the world in addressing the crisis of global warming.

Despite what virtually all Republicans and some Democrats want, we must not balance the budget on the backs of a collapsing middle class or the poorest people in our society.

Despite what virtually all Republicans and some Democrats want us to ignore, we must create the millions of jobs working families still desperately need.

The American people have been very clear, in poll after poll, that they do not want to cut Social Security, Medicare, Medicaid, veterans’ needs, education and other vitally important programs. They also have been clear that they do want the wealthy and large corporations to start paying their fair share of taxes. This agenda, the agenda of the American people, is what I will be taking into the lame-duck session. I ask for your support.

Follow Sen. Bernie Sanders on Twitter: www.twitter.com/SenSanders